Yes, well, so I've been silent for a lot longer than I thought. Truth be told, I can't seem to garner the enthusiasm to analyze the Prosper data files lately. However, Prosper today made a great change and started linking loans to listings in their API. That's huge. Maybe I'll resume some work in the near future. Right now I'm mostly occupied building a new, faster desktop that perhaps will crunch the Prosper data files faster.

I've also started to check out LendingClub, the facebook P2P loan application. As a first test, I've used their automated portfolio builder to put together a $500 portfolio of 20 loans of $25 each. Based on my Prosper experience, lending by the numbers are far more likely to yield desired results (if it is a return of your funds that you desire, that is).

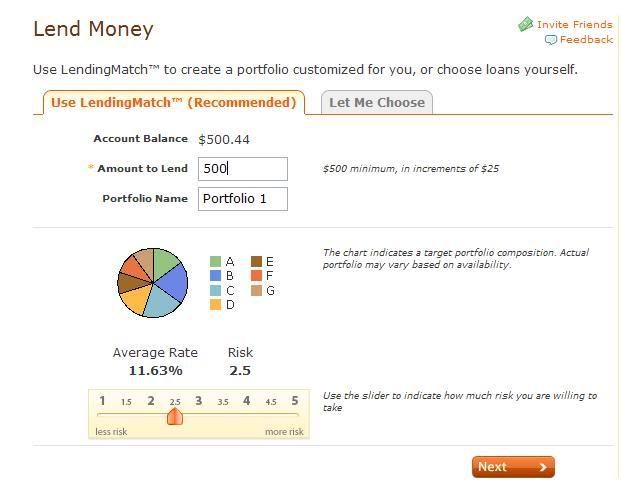

Difference with the automated portfolio builder, I didn't get to specify as many criteria as I do with a Prosper standing order, I merely selected my desired return (see image).

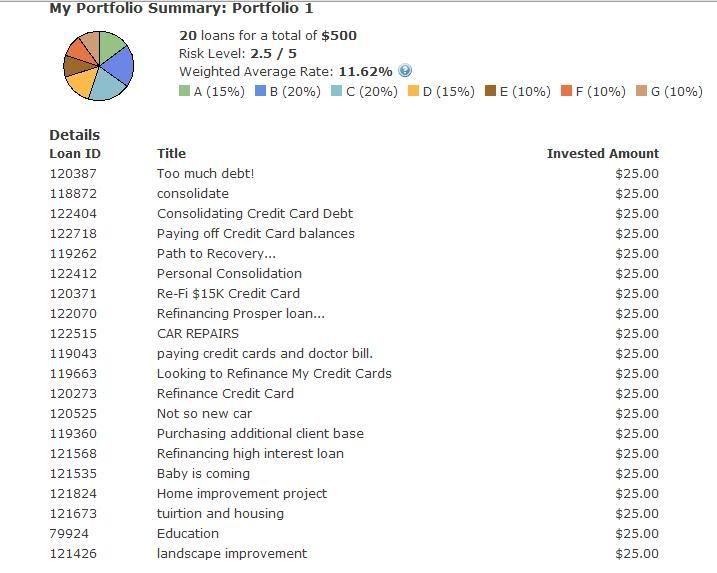

After that, Lendingclub churned away and displayed a list of selected listings. It was possible to adjust the amount targeted for each listing, or to discard the listing entirely, it was also possible to add additional loans to the portfolio. I choose to do neither and in short order I had the following portfolio.

In a few months I'll let you know how that's working out for me.

Friday, August 17, 2007

My first Lendingclub portfolio

Subscribe to:

Post Comments (Atom)

1 comment:

Great to see you posting again!

I've been writing a lot about Lending Club lately. It's very interesting to look at the differences. I look forward to your analysis.

Post a Comment